Bank lobby reception robots, also known as “Guide and welcome robots,” are transforming the banking industry by introducing cutting-edge technology into customer service. These robots are enhancing service efficiency, personalizing customer experiences, and reshaping the way banks operate. In this article, we will explore the various advantages of implementing reception robots in bank lobbies and how they are revolutionizing the industry.

1. Improved Service Efficiency

One of the most significant advantages of using reception robots in bank lobbies is the boost in service efficiency. Traditionally, customers often had to endure long waiting times, which wasted their time and reduced overall operational efficiency. Reception robots solve this problem by automating and streamlining the service process.

These robots are equipped with voice recognition and interactive technology, allowing them to quickly understand customer queries and provide immediate assistance or guidance. For example, if a customer inquires about a specific banking service, the robot can instantly provide detailed information and direct the customer to the appropriate counter or self-service machine. This quick, efficient service reduces waiting times, streamlines operations, and ensures a smoother banking experience.

2. Personalized Customer Service

Another advantage of bank lobby reception robots is their ability to offer personalized services. Every customer has unique needs and preferences. By collecting and analyzing customer data and behavior patterns, robots can provide tailored services to meet individual requirements.

For instance, based on a customer’s financial profile and risk preferences, the robot can recommend suitable financial products and services. Additionally, it can prepare relevant documents in advance based on the customer’s transaction history, reducing the complexity of the banking process. This personalized service improves customer satisfaction and strengthens the relationship between the bank and its clients.

3. Interactive and Entertaining Features

Bank lobby reception robots are not just functional; they also enhance the customer experience by providing interactive and entertaining features. While waiting for their transactions to be processed, customers can engage in games, watch videos, or enjoy other forms of entertainment with the robot. This helps alleviate anxiety and makes the wait more pleasant.

Moreover, the robot can communicate with customers using friendly language and expressions, creating a warm and engaging atmosphere. This playful interaction increases customer goodwill towards the bank, making the experience more enjoyable and memorable.

4. Enhanced Security and Privacy

Security is a top priority in the banking sector, and reception robots contribute to improving security and privacy protection. Using facial recognition and identity verification technologies, these robots can accurately identify customers and prevent unauthorized individuals from entering the bank.

Furthermore, robots can encrypt and securely store customer transaction records, ensuring the protection of sensitive information. This enhanced security not only bolsters the bank’s reputation but also provides customers with a safer, more secure environment.

5. Reduced Operational Costs

Reception robots also help banks reduce operational costs. Unlike traditional human staff, robots can operate 24/7 without breaks, reducing the need for human labor and associated costs. Additionally, robots have lower maintenance and upgrade costs compared to hiring and training new staff, which results in significant savings in the long run.

This cost efficiency allows banks to provide high-quality services while maintaining profitability, making the use of robots a smart investment for the future.

Conclusion

The implementation of bank lobby reception robots (迎宾机器人) offers numerous advantages, including improved service efficiency, personalized customer service, interactive entertainment features, enhanced security, and reduced operational costs. These robots are transforming the banking industry by providing faster, more efficient, and more personalized customer service.

As technology continues to advance and costs decrease, the use of reception robots is expected to expand and become more widespread across the banking sector. While challenges remain, the future of banking will likely see an increased integration of these robots, blending high efficiency with a human touch to create a warmer and more caring service experience.

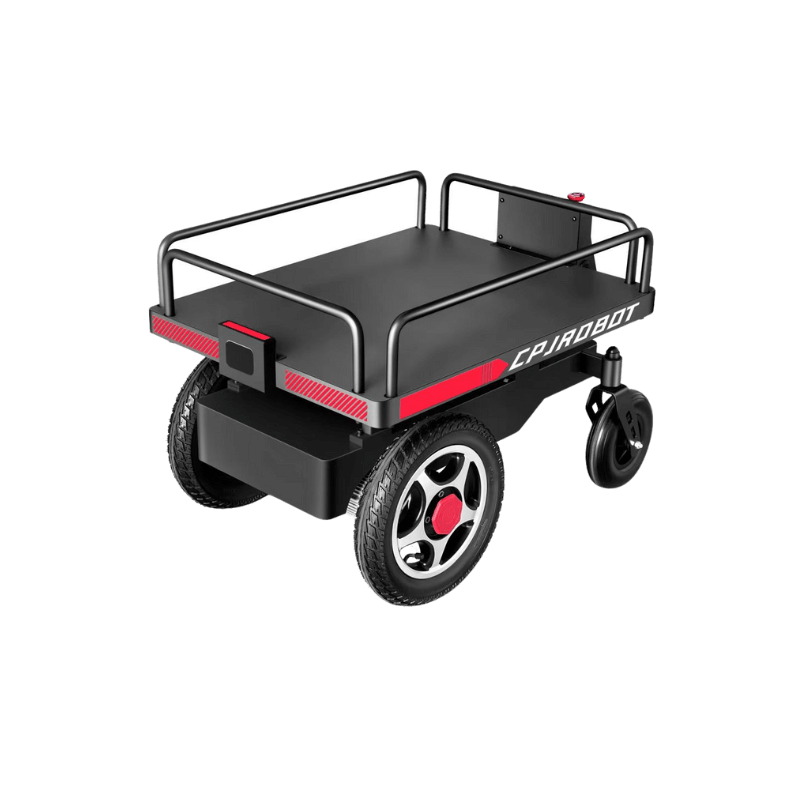

If you’re ready to revolutionize your bank’s customer service with cutting-edge reception robots, look no further than CPJ ROBOT. Specializing in the manufacturing of delivery robots, navigation robots, and hotel robots, CPJ ROBOT offers customizable OEM & ODM solutions with multi-functional and multilingual capabilities. Contact us today to learn how we can tailor our robots to meet your specific needs.